Table of Contents

Why Finance Leaders Are Prioritizing ERP Transformation?

Today, C-level executives are responsible for more than financial oversight. They are expected to guide digital transformation and adopt tools that improve efficiency, compliance, and growth. The choice of an Enterprise Resource Planning (ERP) system is no longer an IT-only decision; it is a strategic financial imperative.

Among ERP solutions, NetSuite ERP Financial Module stands out for its ability to unify financial operations, deliver real-time visibility, and support global scalability. This guide explores how finance leaders leverage NetSuite to achieve measurable ROI, strengthen compliance, and prepare their organizations for the future.

What Is the NetSuite ERP Financial Module?

The NetSuite ERP Financial Module is a comprehensive cloud platform that manages accounting, compliance, reporting, and global financial operations in one system. Unlike traditional ERP systems, which often require multiple integrations, NetSuite offers a single source of truth.

Having a dedicated implementation team ensures:

- Clear ownership of business and IT responsibilities

- Accurate data migration and system configuration

- Proactive risk management to avoid project delays

- Faster ROI realization and operational efficiency gains

NetSuite reports that customers implementing ERP see 40%–55% faster reporting cycles and 40%–60% improvements in order processing efficiency (NetSuite ROI Guide).

Bonus Reading: NetSuite Financial Reporting: Accuracy, Compliance & Control

How Does NetSuite ERP Financial Module Help with Cost Control?

- Automating Manual Processes: The platform replaces spreadsheets and manual processes with automated workflows. This reduces the risk of errors while freeing up finance teams to focus on analysis rather than repetitive tasks.

- Monitoring Expenses in Real Time: Executives can track expenses by department, region, or business unit, providing immediate visibility into cost drivers. This real-time control helps organizations identify inefficiencies quickly.

- Optimizing Resource Allocation: With clearer financial insights, CFOs can allocate resources strategically, ensuring capital is invested in high-value initiatives.

The result: reduced operational costs and improved return on investment (ROI).

How Does NetSuite Manage Revenue Recognition?

- Automating Compliance with ASC 606 and IFRS 15: Revenue recognition remains one of the most complex areas in finance. The NetSuite ERP Financial Module automates compliance with ASC 606 and IFRS 15 standards, reducing risks of misreporting and audit penalties.

- Supporting Diverse Business Models: Whether your organization runs on subscription services, project-based billing, or multi-element arrangements, NetSuite provides flexible recognition schedules. This ensures that financial statements accurately reflect revenue streams.

- Reducing Risk of Restatements: Automated recognition processes reduce reliance on manual adjustments, minimizing the chance of restatements and protecting executive credibility with investors and regulators.

How Does NetSuite Simplify Consolidated Reporting?

- Managing Multi-Currency and Multi-Entity Operations: For global organizations, consolidating data across entities and currencies can be a major challenge. NetSuite automates conversions and consolidations, ensuring accuracy.

- Generating Real-Time Consolidated Financials: Executives gain access to real-time consolidated reports, replacing month-end wait times with immediate insights.

- Meeting Local and International Compliance Standards: The system aligns reporting with both local and global standards, helping multinational enterprises maintain compliance without additional overhead.

This enables CFOs and CEOs to make confident, data-driven decisions for both local and global operations.

Bonus Reading: NetSuite Multi-Currency Accounting: Global Finance Made Easy

How Does NetSuite Enhance Financial Visibility?

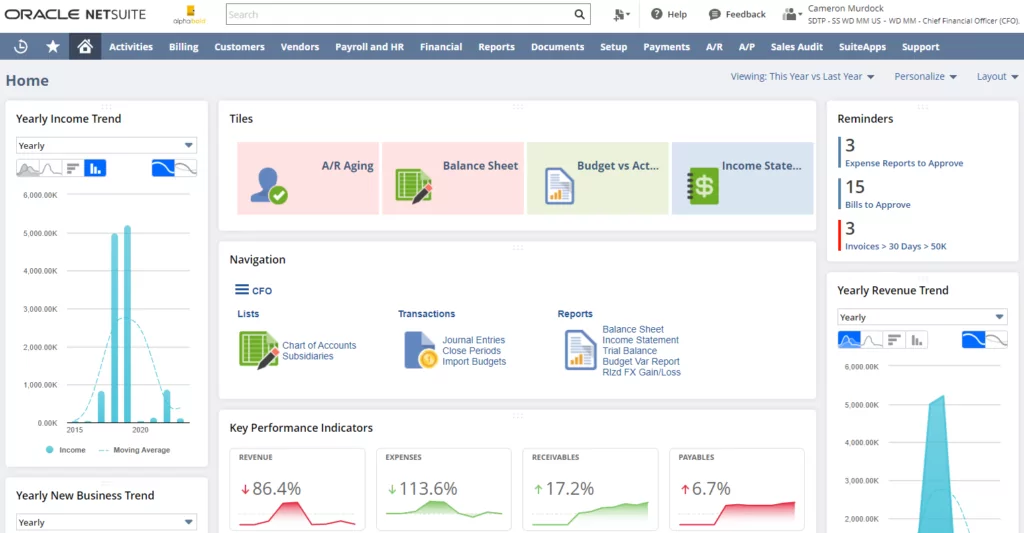

Financial visibility is not just about having access to numbers, it is about understanding them in real time to make informed decisions. The NetSuite ERP Financial Module provides a consolidated view of transactions, cash flow, budgets, and forecasts across the enterprise.

With NetSuite, CFOs and financial leaders can drill down into real-time dashboards, automate compliance reporting, and align financial performance with broader business objectives, without relying on outdated spreadsheets or delayed reporting cycles.

Real-time Financial Data:

- With a cloud-based platform, executives access live financial data across geographies. This ensures quick responses to market shifts, unexpected expenses, or opportunities without relying on outdated reports.

Comprehensive Dashboards:

- NetSuite dashboards turn raw data into actionable insights. Executives can customize views, cash flows, forecasts, and KPIs, ensuring they monitor the metrics most critical to their role. Dashboards are intuitive, keeping leadership aligned with organizational health at all times.

Risk Management & Compliance with NetSuite

Risk and compliance are core to financial integrity. NetSuite mitigates risks while ensuring global compliance:

- Audit Trails: Every financial transaction and modification is logged, providing clear accountability and fraud prevention. These trails strengthen transparency and trust while safeguarding against errors.

- Global Compliance: NetSuite adapts to diverse regulatory standards from SOX in the U.S. to GDPR in Europe. Built-in compliance features reduce penalties, streamline reporting, and protect brand reputation.

NetSuite ERP Financial Module Role in Empowering Business Expansion & Scalability

Businesses are constantly evolving, expanding, and adapting to changing markets. An ERP system must support both current operations and future growth. NetSuite, with its scalability, is designed to meet this need. Let’s explore how:

- Mergers & Acquisitions: NetSuite simplifies the integration of financial systems during M&A activities, reducing silos and ensuring faster alignment of financial data. This helps companies realize value from acquisitions faster.

- Expansion: NetSuite supports multi-currency, tax, and compliance requirements for global growth. Its scalability ensures financial stability across markets while adapting to diverse regulations.

ROI & Total Cost of Ownership (TCO)

C-level executives evaluate ERP investments by analyzing both upfront costs and long-term value. This involves assessing Return on Investment (ROI) and Total Cost of Ownership (TCO). NetSuite delivers strong results across both measures.

- Long-Term ROI Benefits: NetSuite reduces reliance on multiple systems, lowering maintenance and training costs. Automation drives efficiency, reduces cycle times, and saves labor costs, delivering strong ROI over time.

- TCO vs. Other ERP Solutions: Legacy ERP systems often require heavy infrastructure and IT staff. NetSuite’s subscription-based cloud model minimizes these costs, offering predictable expenses and reduced downtime risks.

See the ROI of NetSuite with AlphaBOLD

AlphaBOLD combines deep NetSuite expertise with financial consulting to optimize ROI and streamline operations.

Request a DemoSecurity Aspects Crucial for Finance

With rising data breaches and cyberattacks, financial security now means protecting data, transactions, and client information. NetSuite addresses this with robust security measures to safeguard financial data.

Data Protection:

NetSuite secures financial data through multiple layers of protection:

- Encryption: Data in transit and at rest is encrypted using industry standards, preventing unauthorized use.

- Role-Based Access: Permissions are restricted to authorized personnel based on responsibilities.

- Two-Factor Authentication: Users must verify identity through two methods before access is granted.

Disaster Recovery and Data Backup:

NetSuite ensures business continuity with:

- Regular Backups: Automated backups are stored across multiple geographic locations.

- Rapid Recovery: Cloud-based protocols enable fast data restoration with minimal downtime.

- Continuous Monitoring: Systems are monitored 24/7 to detect and address threats proactively.

NetSuite provides more than data storage; it protects financial information with security measures built to withstand evolving cyber threats, giving C-level and finance managers confidence in their data’s safety.

Conquer ERP Selection With Our Free Checklist

Streamline your ERP selection process with our comprehensive checklist, ensuring you make informed decisions for your business's future success.

Learn more

Integration Capabilities for Financial Systems

An ERP system’s value depends on its features and how well it integrates with other financial tools. From accounting software to banking systems and payment gateways, NetSuite enables seamless connectivity, ensuring these tools work together efficiently.

Integration with Financial Tools:

NetSuite supports both its native financial suite and external systems:

- Open API Architecture: Enables custom integrations with budgeting, forecasting, or other specialized tools.

- Pre-Built Connectors: Ready-made integrations for popular financial software, reducing the need for custom development.

Integration with Banking Systems:

NetSuite streamlines cash flow management and reconciliations:

- Bank Feeds: Automates bank statement imports for faster, more accurate reconciliations.

- Secure Data Transfer: Uses encrypted channels to protect financial data during transfers.

Payment Gateway Integrations:

NetSuite accommodates global payment needs:

- Multi-Gateway Support: Integrates with PayPal, Stripe, Square, and region-specific gateways.

- Automatic Reconciliation: Matches payments to invoices automatically, minimizing manual effort.

An ERP system’s effectiveness depends on seamless integration. NetSuite provides built-in features and the flexibility to connect with external financial tools, banking systems, and payment platforms.

Transform Financial Management with AlphaBOLD

AlphaBOLD helps financial leaders implement NetSuite ERP to maximize reporting, compliance, and operational efficiency. From multi-entity consolidation to advanced analytics, we tailor solutions to achieve lasting results.

Request a DemoConclusion

Modern finance leaders need ERP platforms that go beyond accounting. NetSuite ERP Financials is a strategic enabler that supports executives with accurate insights, global compliance, scalability, and security.

AlphaBOLD helps organizations realize NetSuite’s full potential, driving ROI, reducing TCO, and building financial resilience. Schedule a consultation today to explore how NetSuite can align with your growth strategy.

Explore Recent Blog Posts